How to Calculate Net Profit Margin

Now we need to calculate the profit percentage markup as well as margin. The formula for calculating net profit margin is.

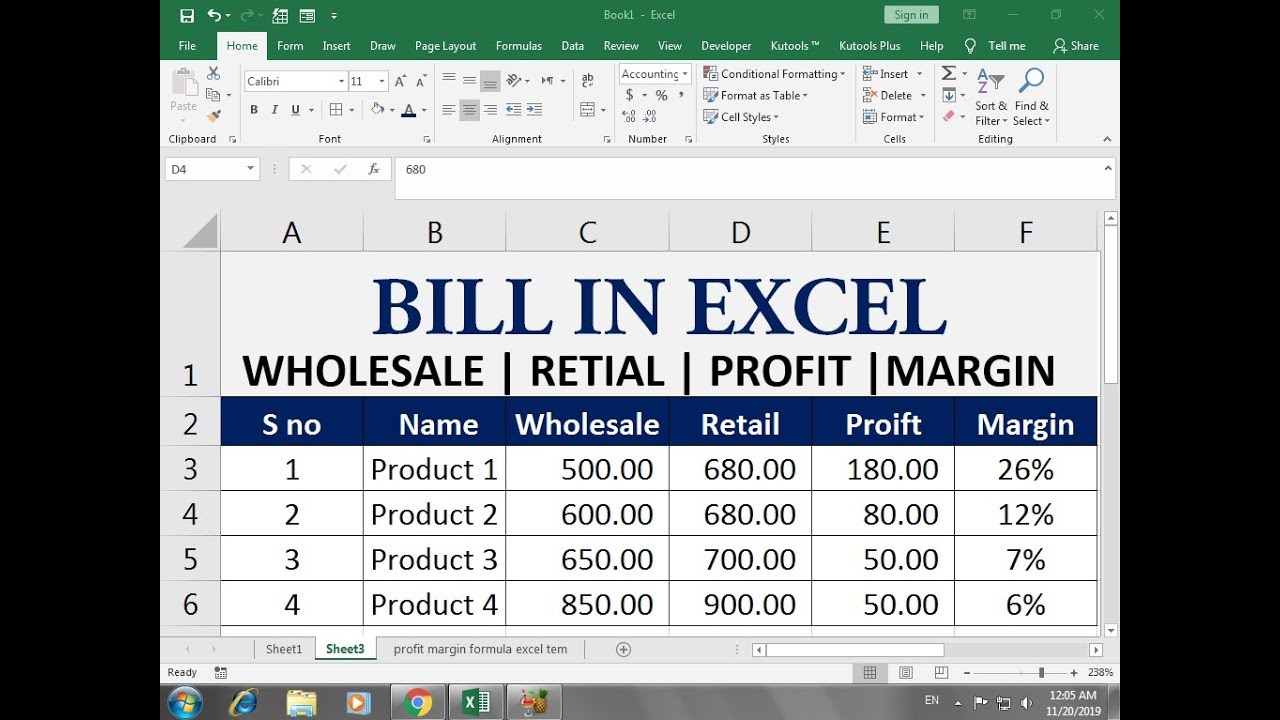

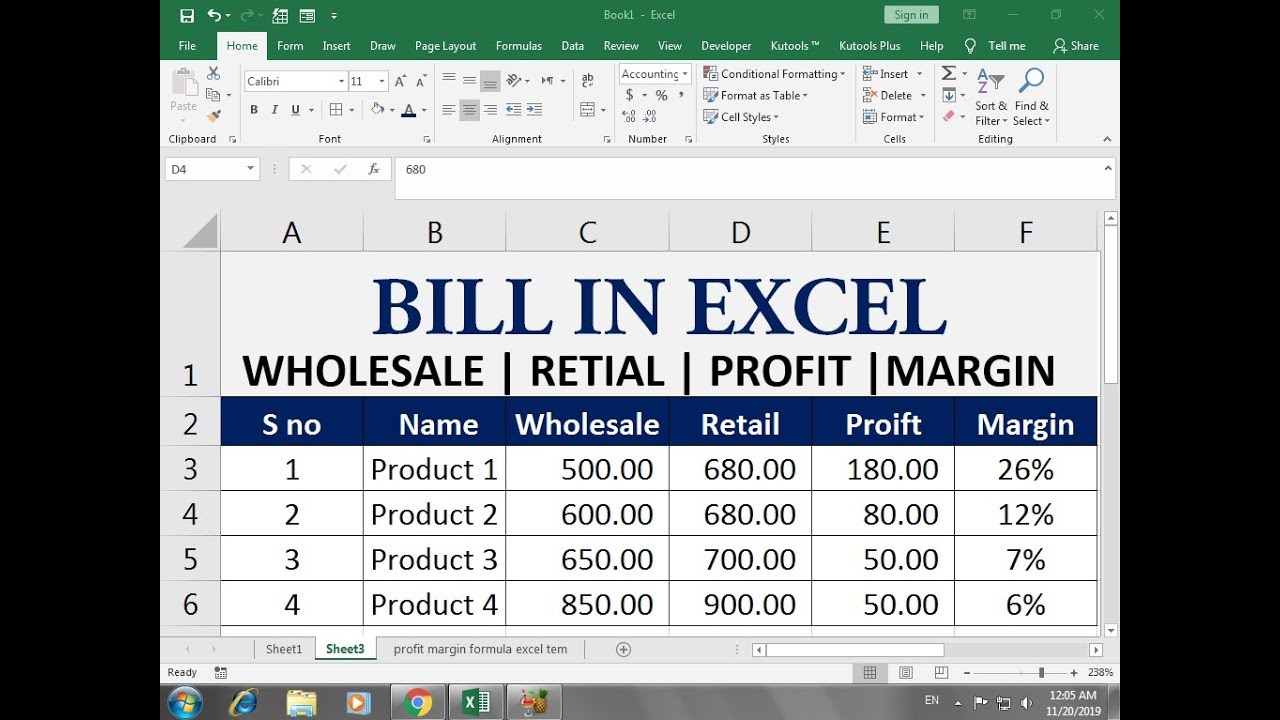

How To Calculate Net Profit Margin In Excel Net Profit Profit Excel

Its only when you calculate percentages that profit and markup become different concepts.

. Net income is the renowned bottom line on a financial statement. Operating Profit Margin differs from Net Profit Margin as a measure of a companys ability to be profitable. The net profit margin considers the total revenue and.

Net Profit Margin Net Profit Revenue. Net profit margin net profit sales x 100. The net profit results from the whole income and expenses rendered by a company.

Because there can be long-term expenses and will serve the company for a long period and as a result maybe the net profit. For instance operating profit margin is calculated without interest or tax while net profit margin considers all expenses related to the production of a product its also known as the bottom line. Its the amount of money you make when you subtract the cost of a product from the sales price.

Where Net Profit Revenue - Cost. Net Profit Margin Net Profit Revenue. Thats why the investors should look at operating.

In business gross profit gross margin and gross profit margin all mean the same thing. Net profit margin and gross profit margin are two measures that are both used to calculate the profitability of a company but there is one key difference. The difference is that the former is based solely on its operations by excluding the financing.

Net margin includes taxes interest paid on debts and indirect expenses such as administrative costs. Net profit margin measures the profitability of a company by taking the amount from the gross profit margin and subtracting other operating expenses. This can then be expressed as a percentage.

Net margin measures how successful a company has been at the business of marking a profit on each dollar salesIt is one of the most essential financial ratiosNet margin includes all the factors that influence profitability whether under management control or not. The data you are looking for may sometimes be found under the net income category Get data on the net profit. Those who obtained a positive result can move on to the second step that we will call Gross Profit Margin.

The average net profit margin for general retail sits at 265 while the average margin for restaurants is 1263. Then divide net profit by revenue to get the decimal form of the net profit margin. This metric indicates.

All you need to do is to divide obtained gross income by total earnings. Find out the net profit of a company by taking a look at its financial statement. For example a 15 operating profit margin is equal to 015 operating profit for every 1 of revenue.

You can use these calculations to work out your gross profit margin and your net profit margin as a percentage. Dont worry the title is bigger than the actual calculation. Gross profit margin shows how efficiently a company is running.

In other words for every dollar of revenue the business brings in it keeps 023 after accounting for all expenses. For example if you sell 15 products for a net revenue of 400 but the cost to source and market your product coupled with business costs equals 350 then your profit margin is 400-350400. So a good net profit margin to aim for as a business owner or manager is highly.

Revenue Selling Price. Profit Margin is calculated by finding your net profit as a percentage of your revenue. This number is always less than the gross margin.

Use the following steps and the formula above to calculate the gross profit rate. Plus knowing the net margin formula also tells them how much net profit a firm can extract out of their net revenue. The formula for net margin is as follows.

When dealing with dollars gross profit margin is also the same as markup. The net profit margin can be calculated by subtracting the cost of goods sold operating expenses interest paid and taxes from revenue to determine net profit. Calculating the gross profit percent uses a formula which gives you the gross profit margin as a percentage.

Remember that net profit total revenues - total expenses with total expenses including. Net margin Net income. Keep in mind that there isnt necessarily a good profit margin you should be aiming for.

Profit Percentage Margin Net Profit SP CPSelling Price SP X 100. A vendor purchased a book for 100 and sold it for 125. The key difference between gross margin and net margin is that net margin equals revenue after all expenses have been deducted.

12500 55000 23. Profit Percentage Net Profit Cost. Many firms emphasize net profit.

Using the income statement above Chelsea would calculate her net profit margin as. To quickly calculate the net profit margin follow these easy steps. Calculate the total amount in sales.

The higher the ratio the more effective a company is at cost controlCompared with industry. This calculator can help you determine the selling price for your products to achieve a desired profit margin. For example 001 equals 1 01 equals 10 percent and 10 equals 100 percent.

But if the net profit margin is higher it doesnt ensure the efficiency of a company. However if the investors think that the net profit would increase proportionately along with the net sales the idea is false. A profit margin calculator can help you determine the exact profit margin calculate costs of products and services evaluate if a project is profitable measure revenue and other values.

You should aim to have a significant net profit margin every month for your business to grow. Rather it may hide the actual profit generated by the operating efforts of the company. Net Profit Margin vs.

Net Profit Margin Each of these profit margins weigh the cost of doing business with or without certain costs factors. It is determined by subtracting the cost it takes to produce a good from the total revenue that is made. The final step is to work out your gross margin as a percentage.

How to calculate profit margin. Gross profit margin gross profit sales x 100. Profit percentage is similar to markup percentage when you calculate gross margin.

How to Use Operating Profit Margin. How to calculate gross profit percentage. This is the percentage of the cost that you get as profit on top of the cost.

To calculate the Gross Profit Margin percentage divide the price received for the sale by the gross profit and convert the decimals into a percentage. Net profit margin on the other hand is a measure of the proportion of revenue left after ALL expenses are accounted for. Definition and How To Calculate It.

Lets understand the application of these formulae with the following simple example. By entering the wholesale cost and either the markup or gross margin percentage we calculate the required selling price and gross margin. In this post youll learn how to use the net profit formula to calculate the net profit for your company even if you are not an accountant.

Its also vital for new businesses to break even as it shows if you are making progress. With the right calculations you can create an accurate pricing strategy for your business increase income save money and grow your company. Net income also known as net profit is a single number representing a specific type of profit.

In simple terms this is done by dividing your net profit by your net sales.

Profit Margin Profit Margin Formula Profit Formula Net Profit

Profit Margins In The Era Of Unprofitable Tech Platforms Fourweekmba

Gross Profit Vs Net Profit Definitions Formulas Examples Net Profit Accounting Training Profit

How To Calculate Net Profit Margin In Excel Net Profit Excel Billing Software

0 Response to "How to Calculate Net Profit Margin"

Post a Comment